BNB closed at $606.12 today. The signal says sell. Price action says bullish. One of them is wrong, or both are about to collide in a way that leaves someone holding the bag.

I've been watching this setup for three days now. The divergence between what the indicators scream and what the chart shows isn't subtle. It's a full-blown argument between two sides of the same data set, and I don't like how it's shaping up.

The Sell Signal Nobody's Listening To

The signal score sits at -44.5. That's not mild bearishness, that's a confident "get out" call. Yet the asset ticked up 0.273% today from an open at $604.47, which means buyers showed up despite the warning. This is the kind of setup where you get whipsawed if you're not paying attention.

Here's what bothers me. When I look at the moving averages, they're not even close to friendly territory. The 10-period SMA is at $616.19, which means we're trading below short-term resistance. The 100-period EMA is way up at $821.82. That's not resistance, that's a different zip code entirely.

Both averages flash strong sell. Not neutral, not caution — strong sell. That's the kind of alignment you don't ignore unless you've got a reason, and right now the only reason I see is that price action label saying "bullish." That's not enough.

ADX at 59 Changes Everything

The ADX reading is 59.21. If you've never traded with ADX before, anything above 25 means the trend has teeth. Above 50? That's a trend so strong it doesn't care about your opinion. At 59, we're in the zone where reversals hurt because they happen fast and without warning.

But here's the problem. ADX tells you trend strength, not direction. It's screaming "strong buy" because the trend is intense, but the moving averages say that trend is pointing down. The Stochastic K% at 28.49 suggests oversold conditions, which usually means a bounce is coming. Except we're already seeing that bounce today, and it's barely moved the needle.

I pulled up live cryptocurrency prices this morning to compare BNB against other major coins, and nothing else is showing this kind of split personality. Bitcoin's moving in lockstep with its signals. Ethereum's boring but consistent. BNB? It's the kid at the party who can't decide if they're staying or leaving.

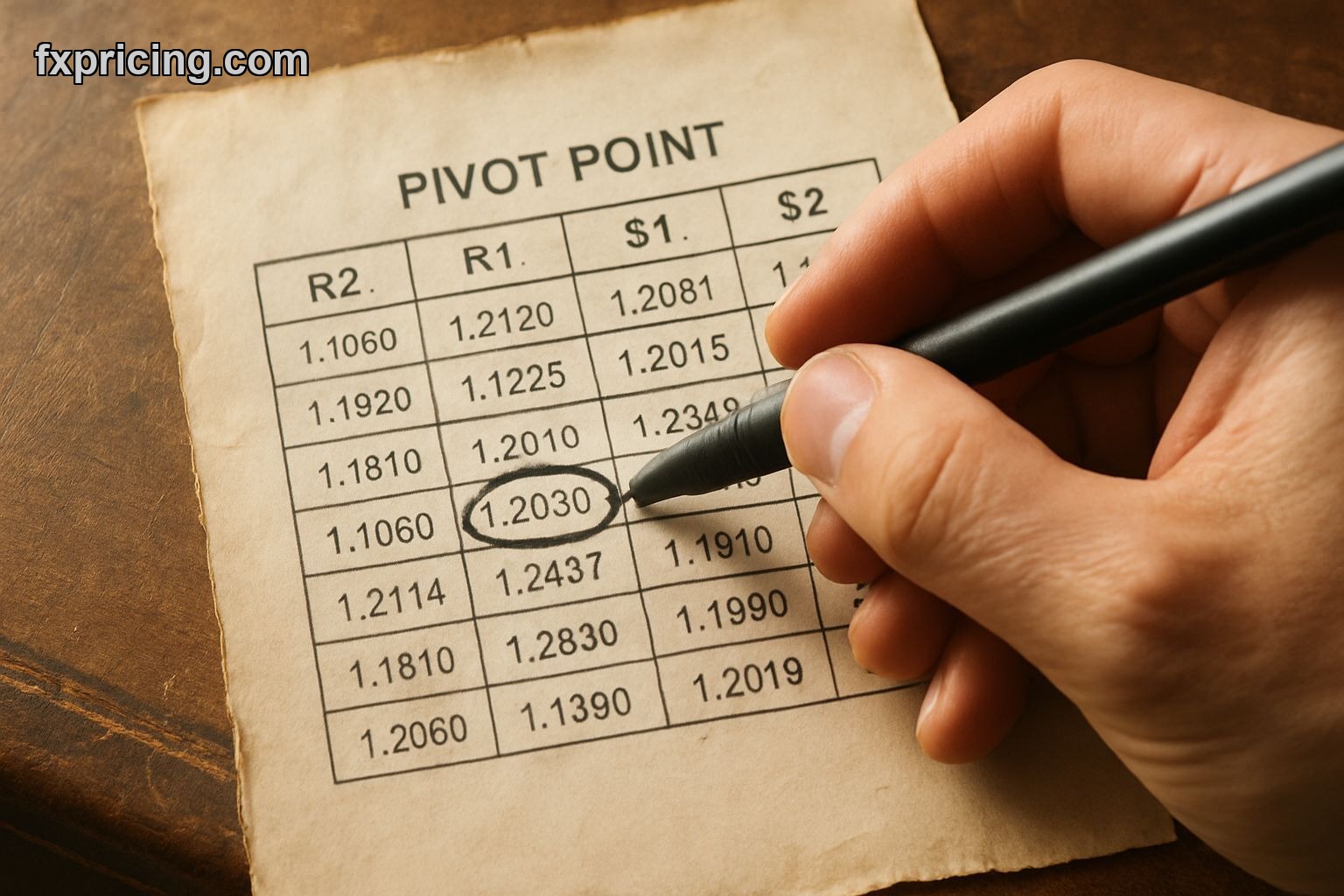

Pivot Points Aren't Helping

The Camarilla pivot points have R1 at $606.78, S1 at $602.21, and the pivot itself at $604.50. We're sitting right between R1 and the pivot, which in theory should act as a decision point. Except we've been hovering here without committing to either side.

When I see price stuck between pivot levels this tight, it usually means one of two things: either we're about to break out hard in one direction, or we're going to chop sideways for days while everyone waits for clarity. Given the ADX reading, I'm betting on the first option. The question is which way.

The Ultimate Oscillator at 52.55 is neutral, which is the most useless piece of information I've gotten all day. Thanks for nothing. At least it's not contradicting anything else, but it's also not helping.

The All-Time High That Doesn't Matter

BNB hit an all-time high of $1,376.26. That was a long time ago in crypto years, and right now it might as well be on Mars. We're sitting 56% below that peak, which tells you everything about the longer-term structure here. The one-month low is $571.20, so we've bounced about 6% off that floor, but it doesn't feel like a reversal. It feels like a dead cat that's still figuring out if it wants to land or keep falling.

I checked the crypto trading pairs to see if BNB was showing relative strength against anything, and the answer is no. It's weak against the dollar, weak against BTC, weak against most majors. The bullish price action label feels like it's describing a very short-term move that the bigger picture is about to erase.

What I'm Doing With This

I'm not touching it. Not long, not short, not with someone else's money. The sell signal makes sense when you look at the moving averages and the overall trend structure. The bullish price action makes sense when you zoom into today's session and see buyers stepping in. But these two things can't both be right for more than a few hours.

If I had to pick a side, I'd lean toward the sell signal winning out, mostly because the moving averages are so far above current price that any rally has to fight through thick resistance. The ADX says the trend is strong, but strong doesn't mean up. It just means it's not going to meander gently. When this thing picks a direction, it's going to move fast.

The Stochastic K% being in buy territory is the one thing that gives me pause. Oversold conditions can lead to sharp bounces, and if BNB pushes through $616 and holds, then maybe the bullish label was early but not wrong. But that's a lot of ifs for a setup where the signal score is sitting at -44.5.

I've seen this pattern before — price making a short-term move that looks optimistic while every structural indicator is flashing red. It usually resolves the way you don't want it to if you're long. The smarter play is to wait for the ADX to calm down or for price to make a decisive break above $616, which would at least flip the short-term average.

Fxpricing Blog covered a similar divergence a few months back with a different asset, and the lesson then was the same as now: when the signal and the price action disagree this loudly, the safest move is to step aside and let someone else figure it out. If you're holding BNB right now and feeling nervous, that's probably your gut telling you something your chart isn't.

So what happens next if the sell signal is right and this bounce fades?