The Federal Reserve just cut rates by 75 basis points in an emergency meeting this morning. Not a scheduled announcement. Not a gradual taper. A Friday morning panic cut that sent every trading desk into overdrive.

Chair Powell's statement cited "unanticipated credit market stress" and "systemic liquidity concerns." Translation: something broke and they're trying to fix it before Monday.

What Actually Happened

Regional bank stocks fell 18% on Thursday. The trigger was a medium-sized commercial real estate lender in Texas that missed a debt payment. Not a household name, but enough exposure to office buildings and retail properties that the contagion risk spooked everyone.

By Thursday afternoon, three other regional banks saw deposit outflows accelerating. Not Silicon Valley Bank levels yet, but enough that the Fed decided waiting until March was too risky.

The emergency cut dropped the federal funds rate to 3.75-4.00%. That's the fastest single cut since March 2020. Markets rallied initially — S&P up 2.1% in the first hour — then gave back half those gains by noon.

The Commercial Real Estate Problem

Office vacancy rates hit 22% nationally in January 2026. That's not just work-from-home anymore. It's also oversupply from the 2019-2021 construction boom that nobody needed.

Property values are down 30-40% from peak in major metros. Refinancing a building you bought in 2019 at today's value means bringing millions in additional equity or defaulting. Most owners don't have that cash sitting around.

- $1.5 trillion in commercial mortgages mature between now and end of 2027

- Estimated 35% of those loans are underwater at current property values

- Regional banks hold roughly 70% of commercial real estate debt

The Texas lender that defaulted had $8 billion in CRE loans. Small compared to JPMorgan, huge compared to its $12 billion deposit base. When property values drop faster than loan loss reserves can cover, the math stops working.

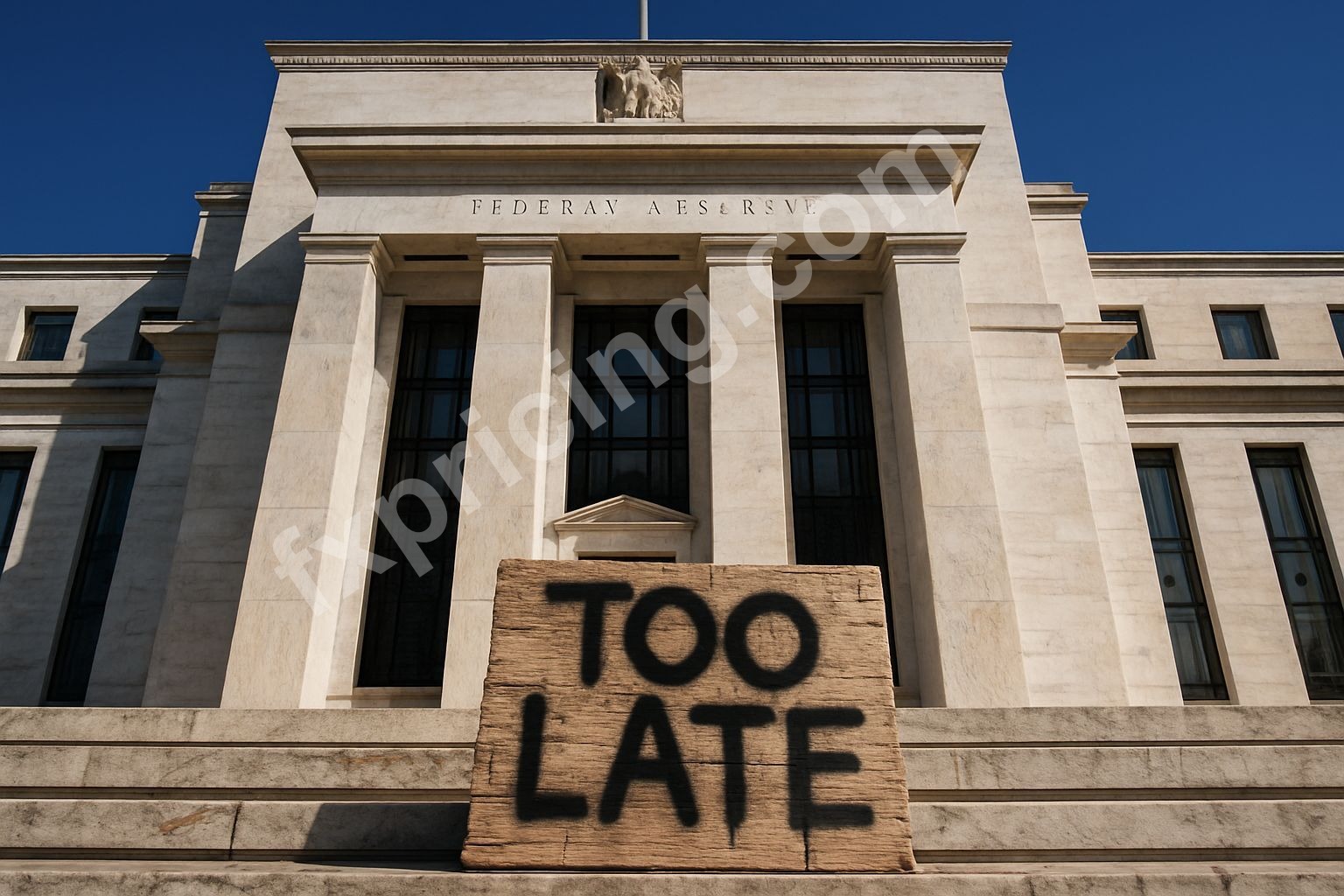

Why This Cut Won't Fix Anything

Lower rates help borrowers refinance. They don't fix empty buildings. A 75bp cut means a $10 million loan costs maybe $60k less per year in interest. Sounds good until you realize the building lost $3 million in value and can't attract tenants at any rent.

The Fed is buying time, not solving the underlying problem. Office space didn't become valuable again just because Powell held a press conference.

Regional banks are stuck. They can't foreclose on every troubled property because flooding the market with distressed assets crashes prices further. They can't extend and pretend forever because regulators and depositors eventually notice. They can't raise capital easily because who wants to buy bank stock when the loan book is full of office buildings nobody uses?

What Could Go Wrong From Here

If deposit flight accelerates, the Fed will need to activate emergency lending facilities. We've seen this movie. Discount window borrowing spikes, stock prices fall, politicians start yelling about bailouts.

The nightmare scenario is a chain reaction. One bank fails, depositors pull money from similar banks, those banks sell assets at distressed prices, asset sales trigger margin calls elsewhere, credit markets freeze up. Classic feedback loop.

Current credit spreads suggest markets are pricing in maybe 15% odds of that outcome. I think it's higher. The Fed wouldn't cut 75bp on a Friday morning if they thought this was contained.

Inflation complicates everything. Core PCE was still running 3.2% in January. The Fed just prioritized financial stability over price stability. That's the right call short-term, but it boxes them in if inflation reaccelerates.

The Currency Angle

Dollar dropped 1.4% against the euro in the first two hours after the announcement. That's huge for a single session. Rate differentials matter and the Fed just widened the gap with the ECB.

Emerging market currencies rallied initially — lower US rates mean less pressure to defend their own currencies. But if this turns into a full crisis, everyone will run back to dollars anyway. Check live forex rates because these moves are far from over.

Crypto had a weird reaction. Bitcoin spiked 6% then fell back 3%. Risk-on or safe haven? Nobody knows anymore. You can track that volatility on live cryptocurrency prices but good luck predicting which way it breaks next week.

What I'm Watching Monday

Bank stock price action. If regional bank shares keep falling despite the rate cut, that's your signal the market doesn't believe this is enough. Watch deposit data — the Fed will publish weekly numbers and if outflows continue, we're headed for